According to Grandviewresearch Report India’s artificial intelligence in fintech market was valued at USD 462.8 million in 2022 and is projected to grow to USD 2,340.1 million by 2030.

AI isn’t a buzzword in fintech anymore, it’s baked into the way the industry runs. Every time you get a real-time loan update, or your payment app flags something suspicious, that’s AI at work. But beyond speed and automation, Artificial intelligence is changing the financial experience itself-making it sharper, safer, and more intuitive.

In just the past few years, the role of AI in fintech market has expanded rapidly. The use of AI in fintech isn’t just transforming how services are delivered, it’s reshaping business models. For startups, it’s how they outpace bigger players. For legacy institutions, it’s how they stay relevant. AI hasn’t just upgraded fintech, it’s redefined it.

The Role of AI in Fintech

How AI is Shaping the Fintech Industry?

Artificial intelligence is what’s under the hood of most fintech innovation. Today, it’s running ID verification in the background, flagging risky transactions, and recommending financial products tailored to each user. And this isn’t experimental, it’s live and critical to business.

Take Razorpay- they use AI to manage transaction-level risk in real-time. Cred applies AI to personalize credit experiences for each user. The point is, AI doesn’t just make fintech faster, it makes it more precise, and way more scalable. The growth of the Artificial intelligence in fintech market reflects how deeply this technology is being embedded across the sector.

AI’s Role in Personalizing Financial Services

If a fintech product isn’t personalized, it’s outdated. AI enables that personalization by continuously learning from your actions- what you spend on, when your income hits, how you invest.

That’s why a savings app might nudge you to save more right after your salary gets credited. Or why a credit app might reduce your EMI after detecting erratic income over the last few months. AI isn’t making generic suggestions; it’s adapting to your life in real time. This is one of the most impactful fintech AI use cases in consumer finance.

How Can AI Help Fintech?

AI for Enhanced Risk Management

Financial risk moves quickly. AI moves faster. Platforms use it to flag suspicious behavior the moment it happens- no waiting for reports, no manual checks.

It’s not just about blacklisting accounts anymore. Artificial intelligence systems understand behavioral patterns. If your transaction timing changes or location pings look off, the system knows something’s up. Risk management is no longer reactive it’s predictive. If you’re asking, “how can AI help fintech in real-time decision making?”- this is your answer.

AI for Regulatory Compliance

Let’s face it, compliance in fintech is a minefield. AI helps navigate it. It reviews thousands of transactions in seconds, automates documentation, and triggers alerts when anything goes off-script.

And when the rules change which, they often do- Artificial intelligence adapts. You don’t have to rewire the entire system. The algorithms learn and adjust, making regulatory tech more agile and less of a bottleneck. This is another clear example of how AI for fintech operations boosts efficiency.

AI in Personalized Financial Products

This is where Artificial intelligence becomes customer-facing. Whether it’s pay-as-you-drive insurance or an investment plan built around your goals, AI helps fintechs move away from cookie-cutter offerings.

It turns massive amounts of user data into sharp insights. So the products you get aren’t just customized, they’re timed right, priced right, and structured for your financial behavior. This is a crucial benefit driving the demand for AI in fintech.

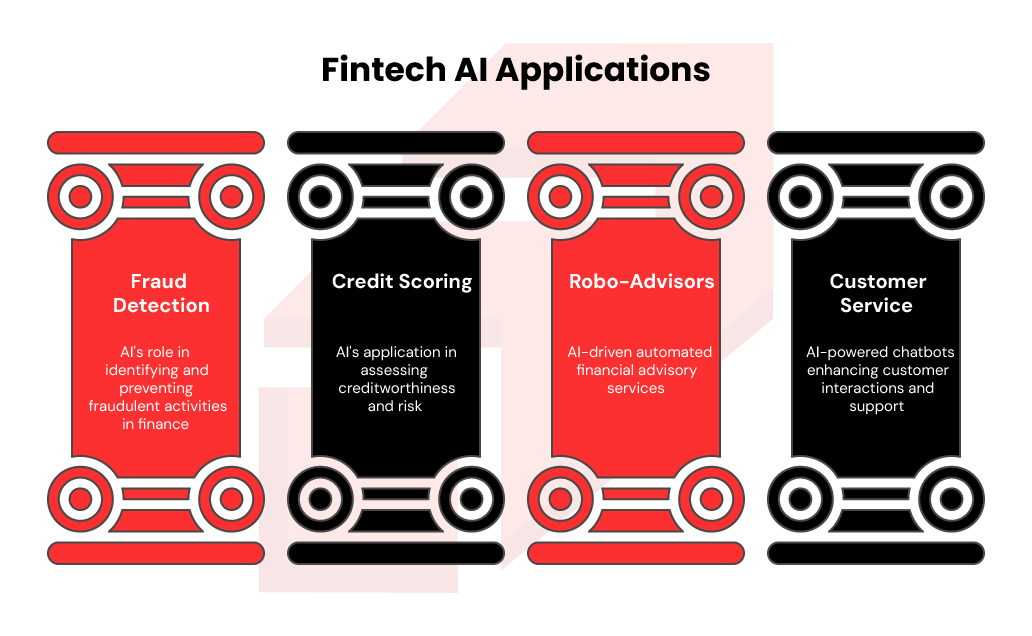

Fintech AI Use Cases

AI in Fraud Detection and Prevention

The fight against fraud has gone algorithmic. Rule-based systems are too slow. AI detects subtle shifts in user behavior like a sudden IP change or unusual transaction velocity and blocks fraud before it happens.

Platforms like PhonePe, Paytm, and fintech wallets rely heavily on these systems. Because they learn from every new attack, the more data AI has, the harder it is to beat. Fraud prevention is one of the most common and successful fintech AI use cases in the industry.

AI in Credit Scoring

Old credit scoring methods don’t work for everyone. Freelancers, gig workers, students, they fall through the cracks. Artificial intelligence changes that.

It pulls from alternate data sources: mobile usage, rent payments, utility bills, and even how someone fills out a form. Companies like ZestMoney are already using this to bring credit access to people who were previously invisible to traditional lenders. This is a prime example of using data-driven AI in fintech to build inclusivity.

AI in Robo-Advisors

Robo-advisors have grown from static tools to intelligent investing assistants. They don’t just assign a portfolio and call it a day- they track market moves, rebalance when needed, and adjust to your changing risk profile.

These tools are especially valuable for people who want smart investing but don’t want to deal with jargon or financial noise. This application of AI for fintech wealth management is helping democratize access to investment advice.

Chatbots and AI in Customer Service

Chatbots have gone beyond scripted answers. Today’s AI bots in fintech can process refunds, approve limits, handle disputes, and even upsell without sounding robotic.

Because they’re trained on real customer data, they get better over time. This means better resolution, shorter wait times, and more meaningful support, especially when users need it most. These are real-world examples of AI in fintech industry customer service.

Harnessing Artificial intelligence Transformative Impact on Fintech

AI isn’t an add-on anymore, it’s your infrastructure. It supports your compliance stack, enhances user experience, and keeps fraud in check. Most importantly, it allows you to build smarter, leaner, and more adaptive products.

But none of this works without intention. You need the right data pipelines, explainable models, and a clear understanding of how AI fits into your growth roadmap. Understanding the role of AI in fintech industry goes beyond technology, it requires strategic thinking and ethical implementation.

The fintech players winning today aren’t the ones with the biggest teams or budgets, they’re the ones using AI with purpose. If you’re building in this space, it’s not a question of should you use AI. It’s how well you can use it to stay relevant, secure, and ahead.

Related Posts

AI-Powered Applications on the Cloud | AI Driven Personalization in E-commerce | Simple Steps To Succeed in AI ML Pilot Projects | Amazon Bedrock The Next Frontier | Role of Agentic AI in Healthcare | What is Agentic AI | Easy Live Video using AI/ML | Top 5 AWS AI & ML Services in 2024 | How Gen AI & Education Transforming Learning | How To Educate Customer on AI & ML | How Generative AI Shapes Cloud Computing