The Digital Evolution of Insurance

Take a deep breath. The insurance world used to be sluggish, wrapped in paperwork and glacial data silos. But that narrative? It’s shifting. Today, about According to Capegemini report 91% of insurers have adopted cloud technology in insurance industry-not just warmed up to it, but accepted it as lifeblood.

We’re not only digital, 85% have accelerated digital transformation since 2020. And customers? A whopping 60% prefer digital channels to manage their policies, with 55% favoring online purchase over agents. Emotion, efficiency, momentum-that’s the stage where insurance is stepping into the future.

How Cloud Adoption in Insurance Is Transforming the Industry

Legacy nightmares:

“legacy systems” your archaic mainframes are sticky, slow, fragmented. They cost in speed, cost in agility, cost in sanity. Cloud adoption in insurance industry slicing through that fragmentation gives insurers the shot to modernize without sacrificing compliance or trust.

Need for speed, scale, security:

Today’s customers demand instant quotes, seamless claims, and iron-clad data protection. Cloud adoption in insurance indsutry holds that promise and scales during peak seasons or disasters.

Cloud as an enabler for modernization

Because the cloud technology in insurance isn’t just an upgrade-it’s a proper revolution. APIs, flexible infra, agile deployments: it’s the toolkit for keeping pace with both regulators and ravenous consumers.

Key Benefits of Cloud Computing in Insurance Sector

Benefits of cloud computing in insurance are now being realised across the board:

For Insurers: Business Benefits

- Cost Optimization

Picture a world without relentless capital splurges on servers and upkeep. With pay-as-you-go models, insurers only pay for what moves-the rest stays quiet. - Scalability and Flexibility

Rain or shine-or catastrophes-systems swell or shrink. You don’t overbuild; you respond when needed. - Faster Product Development & Time-to-Market

Cloud platforms are like creative accelerators-testing new products, racing them live, shortening the gap from idea to doorstep. - Improved Operational Efficiency

Automation and AI in the cloud, powered by effective cloud data analytics solutions, mean claims are processed, underwriting hones sharper, documents flow without friction. - Enhanced Data Security and Compliance

Encryption, MFA, and built-in compliance to frameworks like GDPR, HIPAA or IRDAI in India, it all makes cloud computing and insurance a fortress rather than a gamble.le. - Business Continuity & Disaster Recovery

When chaos strikes like cyber or natural disaster, the cloud extends a lifeline through backups and DRaaS. - Improved Collaboration & Remote Access

Underwriters in Mumbai, agents in Delhi, support in a café, on weekend or midnight – they all sing from the same digital page. - Data-Driven Insights & Predictive Analytics

Fraud detection, pricing intelligence, customer segmentation all are now powered by cloud-based analytics and AI/ML muscle. - Easier Integration with Third-Party Tools

CRM, IoT, payments-they all slot into cloud ecosystems like puzzle pieces. - Sustainability

Shared, energy-efficient data centers mean a lower carbon footprint than everyone running their own power-hungry servers.

For Policyholders: Customer Benefits

- Faster Claims Processing

Automation dramatically shortens the claims process, reducing multi-week waits to just a few days. - 24/7 Access to Services

Customers can check policies, file claims, and update information at any time, from any device. - Personalized Insurance Products

Cloud analytics use lifestyle, personal data, and risk profiles to create insurance plans tailored to individual needs. - Improved Transparency

Cloud-based dashboards provide clear visibility into policy details, renewal reminders, and claim progress. - Enhanced Communication

Chatbots, instant emails, and timely notifications keep customers consistently informed and connected. - Greater Data Security

Advanced encryption protects sensitive documents, personal details, and medical history from unauthorized access. - Seamless Onboarding

Digital KYC and streamlined sign-up processes make joining a policy quick, smooth, and stress-free. - Lower Premiums (Sometimes)

Improved efficiency and accurate risk assessments can help insurers offer more competitive, affordable premiums.

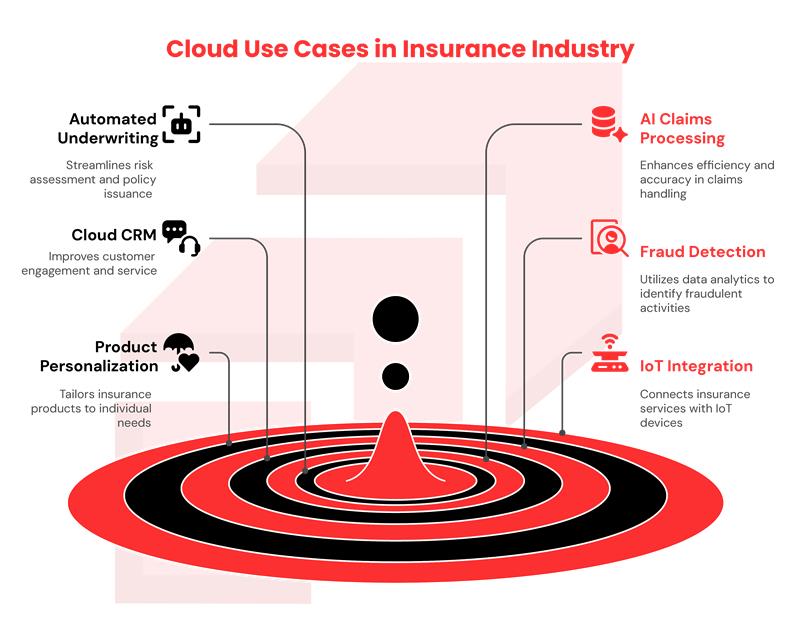

Real-World Use Cases of Cloud in the Insurance Sector

Real cloud use cases for insurance show how insurers are moving beyond theory into practice:

- Automated Underwriting & Risk Assessment

Cloud ingesting mountains of data- demographics, claims, external metrics and churning out smarter, faster underwriting decisions.

- AI-Powered Claims Processing

Centralized claim data, automated workflows, real-time updates, all courtesy of cloud pipelines.

- Cloud-Based CRM & Customer Engagement

Unified customer view, omnichannel communication and data-driven engagement that’s personal are some notable cloud use cases for insurance.

- Predictive Analytics for Fraud Detection

Cloud-powered analytics spot fraud patterns early resulting in saving money and trust.

- Data-Driven Product Personalization

Cloud-crunched insights fueling offerings that feel custom-made.

- Integration with IoT Devices (Health/Auto Insurance)

IoT sensors feeding data back to cloud platforms for real-time risk assessment, usage-based models, smart home insurance scenarios.

Cloud Adoption in Insurance Trends and Issues

Shift Toward Cloud-Native and SaaS Platforms

Modern insurers are pushing beyond lift-and-shift into cloud-native ecosystems, with SaaS architecture for nimble services.

Increasing Investments in AI and ML Capabilities

Cloud computing for insurance companies is the stage where AI plays. Nearly 60% of insurers plan to increase AI/ML investments over the next few years.

Rising Concerns Over Data Privacy and Sovereignty

Geography matters. Data must comply with local laws. Cloud providers now offer regional controls, but vigilance is non-negotiable.

Regulatory and Compliance Complexities

From HIPAA to IRDAI, GLBA to CCPA- each adds a layer of responsibility. Cloud computing and insurance must address these regulatory challenges smartly.

Talent Gap and Training Challenges

Cloud doesn’t just plug in, it needs people who understand it. That gap slows progress unless addressed.

Challenges of Cloud Computing for insurance companies

- Resistance to Change

Many insurance teams are deeply rooted in traditional workflows and hesitate to embrace new systems. Change management, empathy, and hands-on training are essential to gain their trust.

- Legacy System Integration

Outdated mainframes often clash with modern cloud platforms, making integration slow and complex. APIs and phased migration help smooth the process.

- Data Migration and Governance

Shifting sensitive data to the cloud can risk compliance breaches or inaccuracies. Careful planning and strict governance protect integrity and security.

- Vendor Lock-In and Cost Predictability

Depending heavily on one provider limits flexibility and can drive up costs. Strategic contracts and regular reviews help maintain control.

Best Practices for Successful Cloud Adoption

- Define measurable objectives so you can clearly assess cost savings, processing speed, and uptime improvements.

- Select a scalable and compliant architecture that supports multi-cloud, hybrid environments, APIs, and regulatory standards.

- Invest in comprehensive staff training and change management to prepare teams early and with empathy.

- Make security and data governance a priority by implementing encryption, multi-factor authentication, and regular audits.

- Collaborate with experienced cloud consultants who can guide both legacy system migrations and new cloud deployments.

The Future of Insurance with Cloud Technology

Predictive and Prescriptive AI Models Powered by Cloud

Insurers are now using cloud-based AI models that don’t just react to events but predict them, allowing teams to prepare solutions before a customer even realizes there’s a problem.

Hyper-Personalized Policies and Real-Time Claims

With cloud infrastructure in place, companies can design policies that fit each customer’s exact situation and process claims almost as soon as they’re submitted.

Decentralized Platforms and Blockchain Integrations

The mix of blockchain and cloud is opening the door to secure, transparent insurance transactions, making smart contracts a reality instead of a buzzword.

Cloud as the Foundation for Insurance-as-a-Service (IaaS)

By running core operations on the cloud, insurers can offer their products directly through partner apps and services, turning insurance into something customers can access instantly.

Related Posts

Questions to Ask Before Adopting Cloud for FinTech | Robotic Process Automation in Banking | Challenges Faced by Fintech Companies | Cloud Technology and Banking | Top 5 Mistakes Neo-banking Should Avoid | How Cloud Technology Is Transforming Fintech | Cloud Computing For Banking Industry